How to decide if we’re the accountants for you

No one ever really tells you how to pick an accountant. One of the most important things to research is their values. Knowing what an accounting firm values tells you so much about the kind of people you’re going to work with and the relationship you’ll be entering into.

If you’re looking for your first accountant, location may seem like the most sensible search criteria. But in a digital world, geography doesn’t need to be the deciding factor. Many accountants operate online and work with clients all over the country.

If you’re looking to switch accountants, a firm’s service offering may play into the decision. You might be looking for help with a specific service your existing accountant doesn’t provide.

Let’s say you find a bunch of accounting firms in the right location offering the services you know you need. Then what? How do you choose between all the options?

This is where values come in, and why they’re so important.

Values are important in all relationships. In any partnership you enter into, each partner will bring their own set of values to the table. When those values match, a partnership has strong foundations.

It’s the same in professional relationships. The best accountant for you is one that shares your values. They’ll care about the same fundamental things you care about, and place importance on the same principles you do.

At Bloom, family is the most important value

My main reason for starting a business was flexibility and freedom. To know if I need to drop something at a moment’s notice I could afford to, without any hassle or grief. To have the opportunity and ability to be more present in my children’s lives, especially as they are growing up. To be able to do the daily school run, and be around for them. I know I wouldn’t have that level of flexibility and opportunity had I continued working in the corporate world.

In the fast-paced world we live in, it's all too easy to get swept up in the daily rat race, chasing after money and success. And I get it, I've been there too. But what I've come to realise is how easily this pursuit can blur our focus on what truly matters in life. The never-ending grind might bring short-term gains, but it can also mean losing out on precious moments with family, friends, and the things that ignite our passions.

At Bloom, we've embraced the importance of striking a balance that lets us achieve our goals without sacrificing the joys and meaningful connections that make life truly worthwhile. Beyond just crunching numbers and dealing with spreadsheets, our mission is to help our clients build thriving businesses that cherish what's genuinely important in their lives. It's about finding success without losing sight of the things that bring us true enjoyment and happiness.

A life-changing experience within my family completely shifted my outlook on both business and life. Honestly, it shouldn't have taken such a drastic event to open my eyes to the significance of making time for the people who truly matter. But it did, and it was a wake-up call that taught me a crucial lesson. Now, I wholeheartedly understand the value of cherishing moments with our loved ones and ensuring they remain a priority in our busy lives. It's a lesson I carry with me every day, and it's at the core of how I approach my work and personal life.

My mission is to help business owners find the same freedom and flexibility without having to go through a big wake up call or life-altering event.

At Bloom we don’t hope for balance to eventually happen. We help our clients create it. We make sure they can fulfil their ambition of running a successful business without missing out on the important things in life.

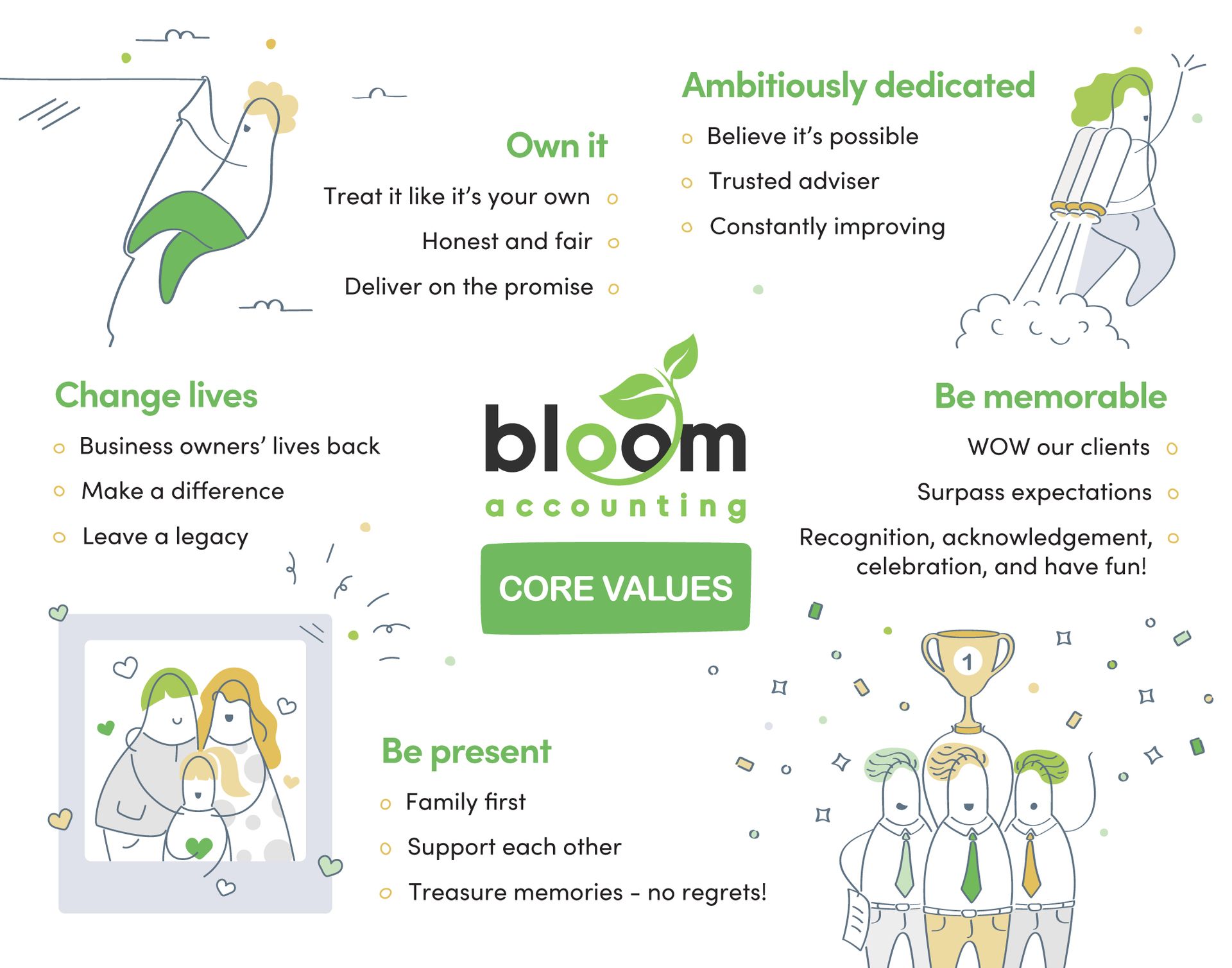

Our values

At Bloom, our values are at the heart of everything we do. They're the foundation of our culture, driving our daily actions – how we behave, the choices we make, and how we work with and treat others.

What our values mean in more detail

Be present

- At Bloom, family is THE most important value and they come first before everything else.

- We support our staff, clients, colleagues and whoever may need our help.

- Our mantra: enjoy doing what you love doing and who you love doing it with - treasure those memories and have no regrets! Live your life.

- We build good relationships with our clients, based on mutual respect and appreciation.

Change lives

- We help business owners’ get their lives back and free them from the shackles of their business.

- We make a difference to our clients, staff, colleagues, those linked to our business and those who are not.

- We strive to make an impact and change the lives of those less fortunate.

- We want to leave a legacy by helping business owners to build a business that they can be proud of and one that impacts lives.

Own it

- We treat our clients' business as though it is our own business.

- We do everything with 100% transparency. We will always be honest and fair and expect our clients to be too - we don’t do dodgy!

- We will always deliver on the promise - we will never go back on our word and will always do what we said we would.

- We expect integrity and honesty from our clients too.

Ambitiously dedicated

- Be ambitious and aim high - believe it's possible. No negative mindset.

- We’re completely dedicated to helping our clients achieve their business and personal goals as their trusted adviser.

- We’re innovative, always looking to deliver better and constantly improving ourselves and our service.

Be memorable

- We provide an exceptional 5 star service to our clients - we aim to WOW.

- We recognise and celebrate our wins and our clients and have fun along the way!

- We want our clients to enjoy the process and feel like running a business is fun and rewarding. We celebrate their milestones with them.

Think we might be a good match?

Now you know a little more about us, visit our how we work page to see the services we provide and how we can help you free up some time.

Maybe you already have a strong gut feeling we’re your kind of people, and you want to skip straight to a conversation. You can do that here.

We look forward to hearing about the things you hold most dear, and helping you build a successful business that honours them, not holds you back from them.